The cash basis accounting and accrual basis accounting are the two common accounting methods. Hence, based on the rules established by a government or government agency or based on particular standard accounting practice, sales revenue is calculated in different ways. This amount represents the amount of cash that a business receives from its customers, especially when it is experiencing substantial amounts of returns.Īccording to the generally accepted accounting principles (GAAP), sales revenue is recognized on the income statement for the month in which the product or service was sold or fulfilled. The Net Sales Revenue, on the other hand, is derived by subtracting sales returns and allowances from the gross sales revenue figure. It is the one that is reported at the top of the income statement. The company’s Gross Sales Revenue includes all receipts and billings from the sale of goods or services and would not include any subtractions for sales returns and allowances. When revenues exceed expenses, profit is made but when expenses exceed revenue, there will be a loss recorded. The company’s net income which is known as the bottom line figure is calculated by subtracting expenses from revenue. Sales revenue is also known as sales or revenue on the income statement which is listed as a topline figure. In other words, sales revenue measures the income that is brought in through the company’s core business activities. Sales revenue is the revenue that is generated from a company’s product sales or provided services. Therefore, in accounting, it is calculated by multiplying the number of units sold by the average sales price per unit of that item or calculated by multiplying the number of customers by the average price of services related to the primary operations of the business. Sales revenue is the income that is generated from the sales of products and services. The term ‘sales revenue’ and ‘revenue’ are usually used interchangeably. It is the very first line item available in the income statement and is referred to as the top-line figure. It is also known as revenue or sales which is reported annually, quarterly or monthly in the business’s income statement (Profit & Loss Account).

Is sales revenue debit or credit? Sales revenue is the income that a business generates from the sale of its goods or the provision of its services related to the primary operations of the business. Example: Sales revenue debit or credit?.Sales revenue: debit and credit journal entries.Why sales revenue is not a debit but a credit.

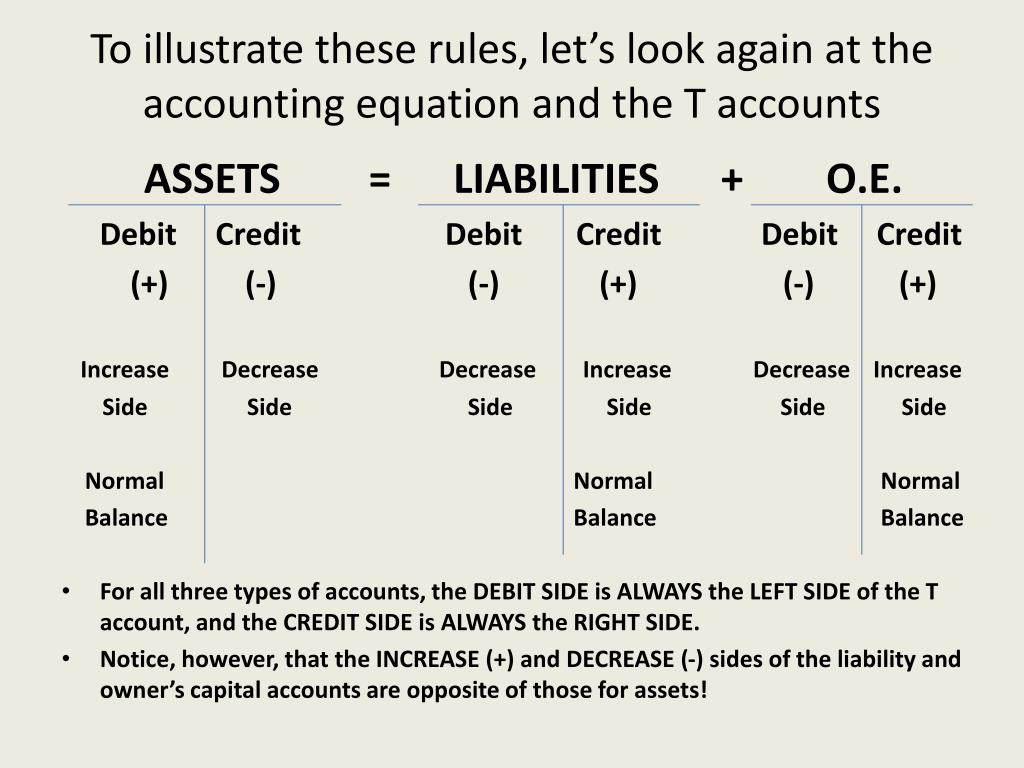

The double-entry system (Debit and Credit).

0 kommentar(er)

0 kommentar(er)